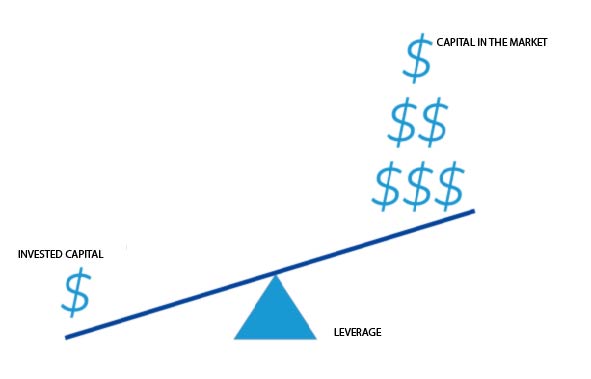

Leverage works as a lever, where we can move more capital than what we have actually invested in financial markets.

Leverage is one of the principal concepts used in trading.

Its structure is the same as when we ask for financial credit. The financial institution lends you its capital for which they will charge you interests and they will ask for some guarantees during the credit life cycle.

In the trading platforms, a financial credit is applied, with the difference that those credits take place immediately after the opening of an order.

Not all the assets or brokers offer leverage. Here you have a list according to typology:

Assets with leverage

- Futures

- Options

- Warrants

- Forex

- CFD

Assets without leverage

- Monetary and deposits

- Bonds

- Shares

- ETF

- Funds

How does leverage work?

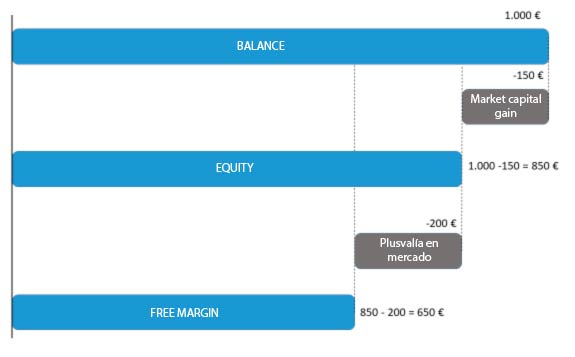

To understand leverage we must have three concepts clear: balance, equity, and free margin:

The balance and equity of an account refer to the result we have in the account. This result should be distinguished in two ways. What we have materialized in the account, that is the balance, and what we have latent according to our profits and losses, that is the equity.

Example, an account where someone has deposited 1.000€, this is the balance.

If there is no open operation in the market then equity will also be 1.000€.

Later on, we open an operation in which we have losses of 150€. Here our equity will be lower than the balance due to our losses.

Equity 1.000€ – 150€ = 850€.

Furthermore, when we open a market operation, it is required a margin of 200€ (the equivalent of the guarantee when we ask for a credit loan). Our margin will be lower than our equity because the operation required a margin that we have deposited at the broker. Margin 850€ -200€ = 650€.

If we want to open more orders with leverage, we cannot surpass our margin limit. If our orders had losses that made our margin worn out we will enter in a Margin call, where the broker should close all our orders due to the loss of guarantee.

When we close an open operation the retained margin is returned to the account.

Leverage: a double-edged sword

Leverage is a very powerful tool but not all are benefits.

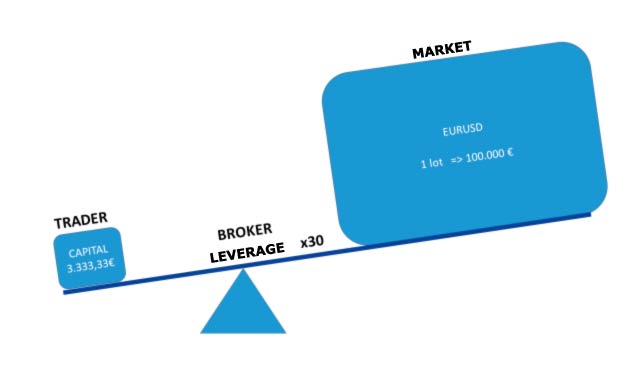

A trader with 3.333,33 €, operating with his broker which offers him leverage of x30 could move 1 set of EURUSD, which means moving 100.000€ in the market.

If we have understood the previous section, we will understand that the trader now has more balance in his account, in order to have a disposable margin after retaining the 3.333,33€ of guarantees and holding its position.

In the case that EURUSD rises a 10%, which would mean a profit of 10.000€ for each set. With leverage, our trader has now 13.333,33€ with a profit of 300%.

However, if the EURUSD would have dropped only a 3,5% that would mean a loss of 3.500€, so the trader would have already lost more than a 100% of the margin deposited for the order.

Leverage limitations in Europe

Given the importance of knowing properly the leverage concept before their usage and the lack of existent formation in traders, ESMA (European Securities Market Authority) decided in 2018 to limit leverage levels for European brokers.

These are the actual limitations depending on the assets:

- Leverage x30 in FOREX (margin 3, 33 %)

- Leverage x20 in CFD on indexes (margin 5 %)

- Leverage x10 in CFD on raw materials (margin 10 %)

- Leverage x5 in CFD on shares (margin 20 %)

Conclusions

As Pirelli said in his slogan in the 95: “Power is nothing without control”.

That is what happens with leverage, is a powerful weapon that you have to know and use with the appropriate knowledge and abilities.

The most important for responsible trading is knowing, learning, and, above all, validate the strategies before investing.

Opera con sistemas validados

Automatiza estrategias creados por ti mismo