Does the perfect trading system exist? No. In the same way that the perfect trader does not exist.

What are you looking in automatic trading? Some people answer this question saying that they are looking for the perfect system, a system to always win. But automatic trading does not have the answers to that problem. The perfect system does not exist.

All trading systems must be validated and when operating with them, periodic evaluations of their functioning must be carried out, how does it interact if there has been any change in the market? Does it work with different assets? Can I improve a system that is working well?

What automatic trading allows us is making quick and efficient validations. If we backtest we can use historical data to see, in only a few seconds, how a system would have worked during a period of time.

How should that system be? When we are creating a trading system or designing an operational strategy, we should find the positive expected value.

What is the expected value? It is an economic concept that allows us knowing the probability that a random event happens. The backtest results will tell us how many operations the system will do and how many of them will be losers and which one’s winners.

Wining more or wining better

A system that wins more times than it looses is not necessarily better than one that does the other way around.

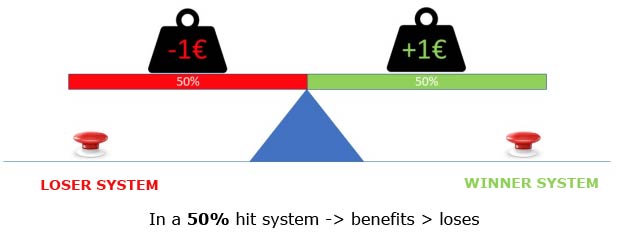

If we have a system that wins the same quantity as it loses but the profit is slightly superior to the losses, then we are in front of a winning system.

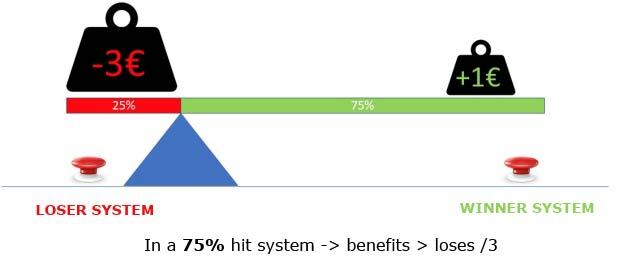

A system that wins 75% of the times (losing 25% of the times) will be a winning system if the looses are at most three times superior.

However, although it wins 75% of the times, it can be a loser if the average losses surpass the triple average benefit.

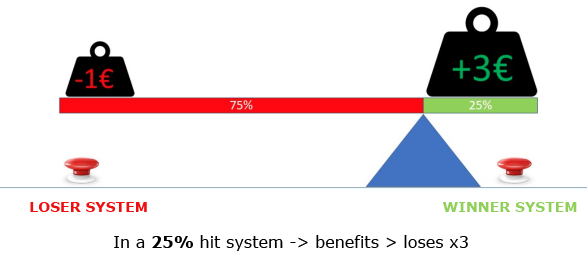

Finally, a system that only wins 25% of the times can perfectly be a winning system is the average profit per operation is bigger than the triple of what it looses in the 75% of the lost operations.

It is important not to establish a winning system only based on the percentage times it wins but on the quantity of money involved in the losses and the profits since this is what is relevant in the balance.

Know your system

Now you know how to determine the positive expected value, you might know something else: on the Internet, you will find the systems that promise that and more, systems that “always win”.

That’s a strategy that has been popularized lately, especially with copy trading strategies, in which there is a payment for the signal subscription. The business model of the person who provides the signal is to earn all of them that copies it, so its business model is not sustainable for the same system.

Is probable that the system fails and do not recover, provoking looses in all the persons who copied the signal, while the supplier has made profits with the subscriptions.

That is what happens when you operate with a system you do not know. You could no have anticipated a drop in the price, you did not have the Stop-loss defined with the loses you could assume.

Defining the trading strategy you want to apply, creating your own system and making the correspondent validations will allow you to operate with a previous functioning knowledge.

Can I do my own trading system?

From AutoTrading Factory we have been devoted to developing a system to our client’s measure, but we also think in the advantages that the development is in traders hands and moreover, facilitating validation.

With tradEAsy you can create, validate and download a system to operate in MetaTrader 4. Start using it with 7 free premium days. Sign up.